Cancer and neoplasms

Taiwan BioMed Industry Eyes $32B

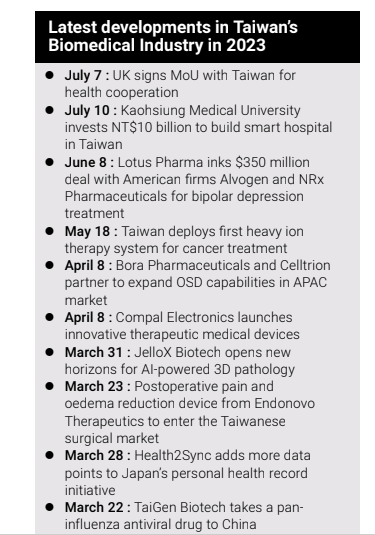

Biomedicine is a top priority for Taiwan, with the government aiming to position the country as the leading hub for biomedical research and development in the Asia-Pacific region. By 2025, Taiwan aims to create 20 new medicines, introduce 80 high-value medical devices to the market, and elevate the biomedicine industry into a trillion-NT-dollar (approximately $32 billion) sector. The government has taken various initiatives, established biomedicines clusters and tweaked policies to achieve this goal. Has the effort paid off? How far has the country come to achieve its goals? Let’s find out.

Taiwan’s ‘5+2’ Innovative Industries Plan prioritises biomedicine. The government approved the Biomedical Industry Innovation Program (BIIP) in 2016 to establish Taiwan as the capital of biomedical research and development in the Asia-Pacific region. Taiwan is harnessing its capabilities in the semiconductor and manufacturing sector to propel the biomedicine sector forward. Thanks to favourable policies and various other initiatives, the biomedicine industry is booming. It’s worth noting that Taiwan’s biomedical industry comprises four major sectors: applied biotechnology, pharmaceuticals, medical devices and healthcare.

In 2021, Taiwan’s biomedical industry reached $23.79 billion in revenue, representing a growth of approximately 17.1 per cent from 2020 ($20.32 billion). While healthcare represents the largest subsector in Taiwan’s biomedical industry, with revenue of $7.59 billion in 2021, or 31.9 per cent of the total revenue in this industry, medical devices rank 2nd with revenue of $8.43 billion in 2021 or 35.4 per cent of the total revenue, according to the latest report from the Biotechnology and Pharmaceutical Industries Promotion Office (BPIPO), MOEA (Ministry of Economic Affairs), Taiwan.

BPIPO is the one-stop service window for Taiwan’s biomedical industry. It is designed to assist companies in the biomedical industries worldwide. The assistance provided by BPIPO includes financial support, investment promotion, stock listing, R&D collaboration, technology transfer, commercialization, marketing, strategic alliances, and others. Over the past few years, BPIPO has helped Taiwan’s biomedical industry obtain investments of more than $1,500 million per year. It has also helped set up around three innovative companies per year.

The pandemic has accelerated the domestic development and manufacturing of biomedical products, and the revenue of the biomedical industry has grown by 10.9 per cent, reaching a record high in 2021 of NTD 666.5 billion over the past decade.

In 2021, Taiwan had 128 listed biotech and medical care companies, with a total value of $38.94 billion. Among them, 75 and 20 companies have registered on emerging and GISA stock markets respectively. Through diverse capital market fundraising channels for operating and R&D funds, the value of Taiwan’s public capital market continues to grow.

In 2022, 172 companies have been certified as biotech companies, and 453 items have been approved, of which 72 products have been approved for marketing both domestically and internationally.

The government’s multiple schemes are successfully attracting more companies to invest in biotech, propelling the industry towards a new era. The bet seems to be paying off with various big pharma firms forging partnerships and expansion in the country. The latest one is the German mRNA major BioNTech SE. In December 2022, the company announced its plan to accelerate and broaden the clinical development of its cancer immunotherapy pipeline in the Asia-Pacific region. As part of this expansion, the company planned to establish new clinical trial sites in East Asia, with Taiwan being the first location. The main objective of these regional trials is to evaluate the effectiveness of BioNTech’s mRNA-based cancer immunotherapy product, BNT113, in treating head and neck cancer.

Supporting innovations

The government has been actively working to establish a biomedical hub in the region, with a particular focus on developing biomedical and innovation clusters. Several significant milestones have been achieved to support this vision. Notable accomplishments include the launch of the National Biotechnology Park in 2018, the establishment of the National Taiwan University Hospital Hsinchu Branch in 2019, and the creation of the Southern Taiwan Science Park Smart Biotech Medical Cluster in 2020.

The government has also implemented policy adjustments and legal amendments to streamline regulations. In December 2021, the legislature passed an amendment to extend tax breaks for biomedical R&D investments until 2031. The amendment covers emerging fields like regenerative medicine, digital health, and precision medicine, providing new tax reductions for biotech and pharmaceutical companies. Additionally, the amendment encourages collaboration between the biomedical industry and other sectors to boost manufacturing capacity.

Taiwan has also implemented significant policy changes for the medtech industry, continually updating medical device legislation and standards. Notable examples include the ‘Medical Devices Act’ of 2020, which introduced the concept of design into medical device manufacturing and regulated medical device repair firms.

Moreover, in 2021, Taiwan amended the ‘Regulations Governing the Administration or Use of Specific Medical Technology-based Testing or Laboratory Medical Instruments’ removing restrictions on cell therapy and autologous bone marrow mesenchymal stem cell transplantation. In the same year, the Taiwan Food and Drug Administration (TFDA), established the Smart Medical Device Office to promote AI/ML-based medical devices and support the Medical Device Act. This dedicated regulatory office will offer consultation services and accelerate the industry’s compliance with regulations. Its key responsibilities include organising training, offering real-time information, facilitating networking between the IT and healthcare industries, and developing a robust regulatory system for AI/ML-based medical devices. The aim is to enhance patient triage, disease detection and diagnosis, and streamline the review process for such devices.

In addition, the government has come up with various subsidies such as the ‘Leap Forward Programme for Cross-industry Integration in Biomedicine’. It encourages R&D projects to foster innovation in medical devices like IoT mobile devices and high-end medical imaging. Grants cover up to 50 per cent of project costs, promoting breakthroughs in technology applications.

Precision health initiatives

Taiwan is particularly bullish on advancing precision medicines. The government launched the ‘Taiwan Precision Health Strategy Development Programme’ in May 2020. As per the programme, Taiwan will build a Taiwan Bio-Medical Data Commons, develop precision disease prevention, diagnosis, and treatment systems, develop high-precision pandemic prevention products, and expand international biomedical business opportunities to promote Taiwan’s pandemic prevention brand across the globe.

There has been a flurry of activities in this space in the country. In June 2023, The United States National Cancer Institute (NCI) and Taiwan announced the signing of an extension to their memoranda of understanding (MoUs) for proteogenomics cancer research with Academia Sinica and Chang Gung University. The Taiwan-US Cancer Moonshot Project was first initiated in 2016 to develop cutting-edge research in precision oncology.

In December 2022, ASUS announced a strategic collaboration with Roche, focusing on developing precision medicine solutions for the rapidly growing field of personalised healthcare. This partnership brings together ASUS’s Lumos Real-World Data Platform and Roche’s extensive drug development expertise. The ultimate objective is to enhance medical efficiency, accelerate research, and improve health outcomes for patients worldwide. In September 2022, Thermo Fisher Scientific joined forces with the Taiwan Precision Medicine Initiative (TPMI) to advance the next phase of a large-scale predictive genomics study. The partnership aims to support TPMI’s ambitious goal of genotyping one million individuals in Taiwan.

In the same month, Janssen Biotech initiated the Janssen-Taiwan Project. The company, along with the Ministry of Economic Affairs (MOEA), has provided $1 million for a three-year collaboration in which ITRI (Industrial Training & Research Institute) and Janssen Biotech can jointly work on DNA-based dual-functioning immuno-oncotherapy for lung cancer. This partnership is aimed to help Taiwan have a head start in the new biotech drug market.

In 2021, Pfizer and the National Institutes of Health formed a precision medicine alliance to advance cancer precision medicine in collaboration with the government. In the same year, a pharmaceutical alliance consisting of Roche, Merck, and Chugai Pharmaceutical signed an agreement with Taiwan’s NHRI (National Health Research Institute) and NBCT (Nation Biobank Consortium of Taiwan) to create a platform for precision cancer treatments using Taiwanese biobanks.

In 2020, Merck signed an MoU with NHRI to enhance the National Precision Medicine Programme for cancer testing and treatment. They aim to collaborate on the 2030 Precision Health System, prioritising the well-being of Taiwanese citizens.

Is it a tall order?

Undoubtedly, Taiwan has made significant strides towards achieving its NT$1 trillion dream in the biomedicine industry.

“Taiwan is an international hub geographically and has high-end talents and technological strength. Taiwan has developed an excellent medical and healthcare system, abundant clinical capacities, good manufacturing process management capabilities, and a complete industrial supply chain. In addition, the Taiwanese government is very supportive of the domestic biotech industry. The above strengths highlight Taiwan’s competitive edge as a biomedicine hub. Taiwan can develop a capital market more beneficial to the long-term development of the biotech industry, and establish relevant policies and regulations in line with industry trends,” said a spokesperson from PharmaEssentia, Taiwan.

PharmaEssentia is a fully integrated global biopharmaceutical developing treatments for myeloproliferative neoplasms, hepatitis and other diseases.

However, the question remains: is this progress enough? Experts are cautious in affirming a definitive yes.

“Taiwan has indeed invested a great deal of academic resources in the biomedicine sector during the past 30 years, including in schools and public or private research institutions. However, Taiwan, as a market for biotech, is small. As a result, Taiwan has not yet nurtured a large biotech company. Over the past two decades, both Taiwan’s private and public capital has mainly been invested in the contract manufacturing of semiconductors or technology hardware. Capital available for investment in biotech has been smaller in size,” said Chun-Hsien (Eddy) Tsai, Chairman and Chief Executive Officer, Ainos, Inc. Ainos is based in Taiwan and the USA. It’s a diversified medtech company focused on the development of novel point-of-care testing, low-dose interferon therapeutics, and synthetic RNA-driven preventative medicine.

The R&D investments made by international pharmaceutical companies in Taiwan are mainly in clinical trials.

“Built upon its long-standing competitive strength in manufacturing, I think Taiwan’s current position as a biomedicine hub is focused on the CDMO (Contract Development and Manufacturing Organisation) or as a hub for cost-effective clinical studies leveraging the excellent resources of the many medical centres in Taiwan,” said Tsai.

To truly become a biomedical superpower, Taiwan must strive for further advancements. Tsai proposes the following measures:

- Setting up of a sovereign fund dedicated to the biomedicine industry, by the government. Taiwan’s strengths in the semiconductor industry and the biotech industry are built on nearly 30 years of investment. However, investors, whether public or private, may have different investment horizons. I believe that some form of patient capital backed by the government would be very helpful.

- Increasing connection and cooperation with the major international biotechnology companies.

- Improving tax policies for intellectual property can be improved. Currently, some tax benefits related to intellectual properties are only available for investments in domestic companies, but not for investments in foreign companies. I believe that extending these incentives to investments in foreign companies will help Taiwanese companies to create more value for their stakeholders when cooperating with foreign companies, helping to shape a multi-trillion-dollar industry.

Taiwan has made significant strides towards achieving its objectives. Strategic initiatives and investments have set it on a promising path and opened up significant investment and collaboration opportunities. As 2025 approaches, the world will be eagerly watching Taiwan’s progress in achieving its ambitious goals.

Ayesha Siddiqui